Open banking will change the way we interact with our money, as Mr Open Banking keeps saying.

What is money? Most often, it is a piece of information on a screen

How do we interact with our money? We open an app and play with it: we search for information, we organise it, we send this information to various parties or we modify or move this data from one place to another.

What changes are people starting to experience in the way they interact with their money?

Opening up access to financial data so that it can be shared and re-used by its owners in such a way that it creates extra value for them is a huge benefit of open banking. However, open banking only starts to fulfil its innovation role when it empowers us to make changes to this data, to move our money so as to facilitate our economic purposes. Most open banking initiatives across the globe are closely looking to free up the payments’ channels we are using to pay what we buy or to transfer value among us.

PSD2 regulation requires banks across EU to expose APIs for payment initiation, in addition to those for account information.

What is a payment in fact? Other than physically putting a banknote or a coin in the hand of another person, a payment is basically a message between two banks. If I am paying to a merchant for a pair of shoes, my bank sends a message to the merchant’s banks informing it that they will receive a certain amount of money from my account. There are various channels by which the two banks send messages between them. One very popular channel is the Visa or the Mastercard cards schemes. Another channel can be the national interbank communication network, another one can be a proprietary cross-border EU interbank communication network. Banks have various channels at their disposal, but consumers can only use the one that was made available to them for each particular situation. For example, when buying a pair of shoes, the only channel we can use is the cards scheme.

The card schemes are old enough to have already become integral parts of our financial behaviours. They work, are fully reliable and secure and we wouldn’t want to change anything about them. But when unexpected things happen and disturb our card payment habit, such as we’ve lost the card or we need to transfer a larger amount of money, we may like to have a solution at hand. This is where open banking brings diversity and provides opportunities of improving consumers’ experience with payments.

Payment initiation through open banking or as it is regulated in EU by PSD2 refers to an easy and extremely secure way for people to do digital payments, meaning to digitally move their money from their bank account to a merchant, utility or another person’s account. Let’s look at all these two categories one by one and explain how it works and why it is different from card payment.

1 Online payments based on open banking

What is it? Open banking makes it possible for us to pay in an e-shop using our bank account directly, instead of using a card number.

How it works? It simply redirects you to your digital banking app where you can approve the payment

With open banking payments, you no longer have to remember your card details.

2 Bill payments based on open banking

What is it? One can pay its electricity bills for instance by simply clicking on a special embedded link in the electronic invoice received by email. That link is called “request to pay”

How it works? The invoice issuer, such as the electricity company, needs to embed such a request to pay on all electronic bills. This is done by integrating a widget based on an open banking payments gateway.

With open banking payments, you no longer have to remember your customer or invoice number for your utility bills.

How does the future of payments look like for businesses?

The COVID-19 pandemic has caused great upheaval in the financial services industry. It has accelerated the trend towards cashless payments and online banking, with clear preferences towards buying online.

In combination with Instant payment schemes, account to account payments as facilitated by open banking are likely to produce a major shift in the ecommerce and online payments landscape.

Unlike the traditional four-party card model (issuer, acquirer, merchant, customer) which takes the payment through a process of settlement and clearing, customers would “push” cleared funds to merchants. This will significantly simplify the existing payment model, with fewer players and interactions involved.

1 Merchants would face strong cost incentives to move to accepting account to account payments over payment cards and digital wallets, particularly in e-commerce. Transaction costs for any merchant who chose to become a PISP would be highly likely to be lower than the current costs of card acceptance, due to avoiding card processing intermediaries.

2 Secondly, should the payment go on an instant payments rail or within the same bank, the merchant would receive cleared funds, faster than through a card scheme network, which will result in significant cost savings related to cash management and liquidity improvement.

3 Consumers would benefit from simpler user experience. Most consumers do not care how they make a transaction, as the payment is the final step to overcome to complete the purchase of a desired good or service. Convenience and speed to complete the payment are the chief considerations, with incentives likely to become an increasingly important part of the mix. Therefore, single-transaction card payments that require the manual entry of card details for each payment, are likely to be the first to be replaced by open banking payments.

Real time payments add a further dimension. All new real time payment infrastructures are built using ISO 20022 messages, such as SWIFT gpi or SEPA Credit Transfer and SEPA Direct Debit.

4 ISO 20022 messages not only allow real-time flows of data over the payment networks, but also richer data sets. The ability to send much richer reference data and attachments along with payment messages opens up many opportunities to address corporate pain points. This is particularly the case for payment automation and reconciliation, which have emerged as core service expectations for corporates.

One important theme here is around access, and more specifically the ability to integrate data from bank partners into corporate systems and processes. The growing adoption of ISO 20022 messages is an important enabler here, as greater global standardisation will smooth the path for integration with a corporate’s existing applications.

Cloud technologies will increasingly form the backbone of these efforts, both in terms of database design as well the potential upsides around scalability and agility. Any financial institution could embark upon a large-scale payments & transactions data strategy by leveraging cloud technologies in at least some form.

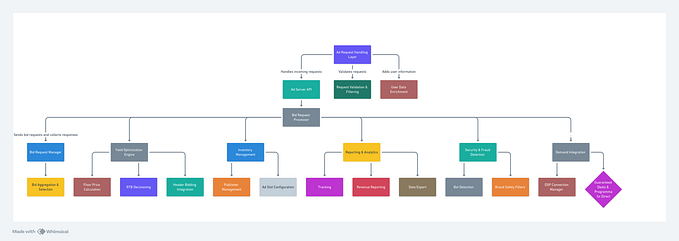

Finqware cloud infrastructure for PSD2 APIs is an open banking payments gateway for the EU markets. It can be integrated into any kind of digital app that needs to enable its users initiate and complete a payment directly from the app, without a card. A live example of how it works on one of our customers’ applications can be seen here.

Future extensions based on its ISO 20022 readiness will add more capabilities such as working with custom payment API’s for ecommerce or corporate payments.